Best Credit Card Debt Consolidation Company

The Best Credit Card Debt Consolidation Company

Welcome to the world of credit card debt consolidation! If you’re feeling overwhelmed by multiple credit card bills and high interest rates, you’re not alone. Fortunately, there are companies out there that specialize in helping individuals like you consolidate their debts into one manageable monthly payment. In this article, we will take a closer look at some of the best credit card debt consolidation companies in the industry, so you can make an informed decision about your financial future.

Top Factors to Consider when Choosing a Debt Consolidation Company

When it comes to choosing the best credit card debt consolidation company, there are several important factors to consider. Making the right choice can have a significant impact on your financial future, so it’s essential to do your research and make an informed decision. Here are the top factors to consider when selecting a debt consolidation company:

1. Reputation and Credibility: The first and most important factor to consider is the reputation and credibility of the debt consolidation company. You want to work with a company that has a proven track record of helping clients successfully consolidate and manage their debts. Look for customer reviews, testimonials, and ratings from reputable sources to get an idea of the company’s reputation. Additionally, check if the company is accredited by organizations such as the Better Business Bureau (BBB) or the National Foundation for Credit Counseling (NFCC). A company with a good reputation and solid credibility is more likely to provide you with the best possible service and outcomes.

2. Services Offered: Different debt consolidation companies offer a variety of services, so it’s important to choose one that aligns with your specific needs. Some companies may focus solely on credit card debt consolidation, while others may offer additional services such as financial counseling, budgeting assistance, or debt management plans. Consider your individual financial situation and goals when selecting a company, and choose one that can provide the services you need to achieve your objectives.

3. Fees and Costs: Debt consolidation companies typically charge fees for their services, so it’s important to understand the cost structure before making a decision. Some companies may charge a flat fee, while others may charge a percentage of the total debt amount. Additionally, be wary of companies that require upfront payments or high fees, as these may be signs of a scam. Look for a company that is transparent about its fees and costs, and choose one that offers a reasonable and competitive pricing structure.

4. Customer Support: When consolidating your debts, you want to work with a company that provides excellent customer support and assistance throughout the process. Look for a company that offers multiple channels of communication, such as phone, email, and live chat, so you can easily reach out with any questions or concerns. Additionally, consider the company’s hours of operation and availability, as you want to be able to access support when you need it most. A company with strong customer support will help you navigate the debt consolidation process smoothly and efficiently.

5. Success Rate: Finally, consider the success rate of the debt consolidation company in helping clients achieve their financial goals. Look for information on the company’s website or ask for data on the percentage of clients who successfully complete their debt consolidation programs. A high success rate is a good indicator that the company is effective in helping clients improve their financial situation and manage their debts successfully.

By considering these top factors when choosing a debt consolidation company, you can make an informed decision that will set you on the path to financial stability and freedom. Take your time to research and compare different companies, and choose the one that best fits your needs and goals. With the right debt consolidation company by your side, you can take control of your finances and work towards a brighter financial future.

Benefits of Using a Credit Card Debt Consolidation Company

When it comes to managing your credit card debt, the idea of seeking help from a debt consolidation company can be daunting. However, there are numerous benefits to using a credit card debt consolidation company that can help make the process of paying off your debt more manageable and stress-free.

One of the primary benefits of using a credit card debt consolidation company is that it can help simplify your finances. Rather than juggling multiple credit card payments with different due dates and interest rates, a debt consolidation company can roll all of your credit card debt into one convenient monthly payment. This can make it easier to stay organized and keep track of your progress as you work towards paying off your debt.

Another key benefit of using a credit card debt consolidation company is that it can potentially save you money in the long run. By consolidating your credit card debt, you may be able to secure a lower interest rate on your overall debt, which can result in significant savings over time. Additionally, a debt consolidation company may be able to negotiate with your creditors on your behalf to lower your monthly payments, making it easier for you to manage your debt without breaking the bank.

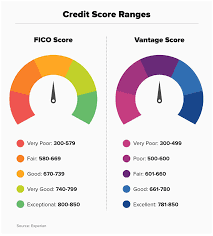

Using a credit card debt consolidation company can also help improve your credit score. When you consolidate your credit card debt, you may be able to pay off your debts more efficiently and consistently, which can have a positive impact on your credit score. By making timely payments on your consolidated debt and reducing your overall debt burden, you can demonstrate to creditors that you are a responsible borrower, which can help improve your creditworthiness over time.

Additionally, using a credit card debt consolidation company can provide you with valuable support and guidance as you work towards paying off your debt. Debt consolidation companies often have experienced professionals who can help you create a personalized debt repayment plan based on your financial situation and goals. They can also offer resources and tools to help you better manage your finances and make informed decisions about your debt repayment strategy.

Overall, using a credit card debt consolidation company can offer numerous benefits that can make the process of paying off your debt more manageable and successful. From simplifying your finances to potentially saving you money in the long run, there are many reasons to consider enlisting the help of a debt consolidation company to take control of your credit card debt.

How to Find the Best Credit Card Debt Consolidation Company for Your Needs

When looking for a credit card debt consolidation company, it is essential to consider several factors to ensure you are choosing the best one for your needs. Here are some tips to help you find the right company:

1. Research Different Companies: Start by researching different credit card debt consolidation companies to see what services they offer and their reputation in the industry. Look for reviews and testimonials from previous clients to get an idea of the company’s track record.

2. Check Accreditation: Make sure the credit card debt consolidation company you are considering is accredited by reputable organizations such as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). Accreditation ensures that the company adheres to industry standards and practices.

3. Look for Transparent Fees and Terms: One of the most crucial factors to consider when choosing a credit card debt consolidation company is the transparency of their fees and terms. Avoid companies that charge high upfront fees or hide their terms and conditions in fine print. Look for a company that is upfront about their fees and clearly explains their services and repayment terms.

4. Evaluate Customer Service: Customer service is another essential factor to consider when choosing a credit card debt consolidation company. Make sure the company has knowledgeable and responsive customer service representatives who can address your questions and concerns promptly. A company that values its customers and provides excellent service is more likely to help you achieve your financial goals.

5. Consider Interest Rates and Terms: Before choosing a credit card debt consolidation company, make sure to compare interest rates and repayment terms. Look for a company that offers competitive rates and flexible repayment options that fit your budget. Avoid companies that charge high interest rates or impose strict repayment terms that may not be sustainable for you.

6. Seek Recommendations: If you have friends or family who have used a credit card debt consolidation company before, consider asking them for recommendations. Personal referrals can provide valuable insights into the company’s services and help you make an informed decision.

By considering these factors and doing your research, you can find the best credit card debt consolidation company that meets your needs and helps you achieve financial stability. Take the time to evaluate different companies and choose one that offers transparent fees, excellent customer service, competitive interest rates, and terms that work for you. With the right company on your side, you can consolidate your credit card debt and take control of your finances.

Top-Rated Credit Card Debt Consolidation Companies to Consider

When it comes to finding the best credit card debt consolidation company to help you manage your finances, it’s important to consider a few key factors. From interest rates and fees to customer service and reputation, there are several things to look for when choosing a company to work with. Here are four of the top-rated credit card debt consolidation companies to consider:

1. National Debt Relief: National Debt Relief is a highly reputable company that has been helping consumers consolidate their debt for over a decade. They offer personalized debt relief solutions tailored to your specific needs and financial situation. With a team of experienced debt negotiators and financial experts, National Debt Relief can help you reduce your debt and improve your financial situation.

2. Freedom Debt Relief: Freedom Debt Relief is another top-rated credit card debt consolidation company that specializes in helping consumers negotiate with creditors to reduce their debt. They offer personalized debt management plans and can help you consolidate multiple credit card debts into one manageable monthly payment. With a strong reputation for customer service and client satisfaction, Freedom Debt Relief is a great option for those looking to get their finances back on track.

3. Accredited Debt Relief: Accredited Debt Relief is a trusted name in the debt consolidation industry, with a track record of helping clients reduce their debt and regain financial stability. They offer personalized debt consolidation programs that are designed to help you pay off your debt in a timely manner. With a focus on transparency and customer satisfaction, Accredited Debt Relief is a great choice for those looking for a reliable and effective debt consolidation solution.

4. Consolidated Credit: Consolidated Credit is a well-established debt consolidation company that has been helping consumers manage their debt for over 25 years. They offer a range of debt relief services, including debt management plans, debt consolidation loans, and credit counseling. Consolidated Credit takes a personalized approach to debt consolidation, working with clients to create a customized plan that fits their individual financial needs. With a strong reputation for customer service and financial expertise, Consolidated Credit is a top choice for those looking to take control of their finances and reduce their debt.

Overall, when choosing a credit card debt consolidation company, it’s important to consider factors such as reputation, customer service, and the specific services offered. By doing your research and comparing your options, you can find the best company to help you manage your debt and improve your financial situation.

Important Questions to Ask Before Choosing a Credit Card Debt Consolidation Company

Choosing the right credit card debt consolidation company can make a big difference in your financial situation. Before making a decision, it is important to ask the right questions to ensure that you are working with a reputable and trustworthy company. Here are some important questions to ask before choosing a credit card debt consolidation company:

1. What are the fees associated with your services?

It is crucial to understand the fees involved in using a credit card debt consolidation company. Some companies charge upfront fees, monthly fees, or a percentage of the amount consolidated. Make sure to get a clear understanding of all the fees before moving forward with any company.

2. What is your approach to debt consolidation?

Every company may have a different approach to debt consolidation. Some may focus on negotiating lower interest rates with creditors, while others may consolidate all your debts into one monthly payment. It is important to choose a company whose approach aligns with your financial goals and preferences.

3. What are your qualifications and credentials?

Before entrusting a company with your financial information, it is important to verify their qualifications and credentials. Look for companies that are accredited by reputable organizations and have certified debt counselors on staff. This will give you peace of mind knowing that you are working with experts in the field.

4. Can you provide references or testimonials from past clients?

Reading reviews and testimonials from past clients can give you valuable insights into the company’s reputation and level of customer satisfaction. Ask the company if they can provide references or testimonials from clients who have successfully used their services to consolidate their credit card debt.

5. What is your success rate in helping clients reduce their debt?

One of the most important questions to ask a credit card debt consolidation company is about their success rate in helping clients reduce their debt. A high success rate indicates that the company is effective in negotiating with creditors and helping clients achieve their financial goals. Make sure to ask for specific statistics or examples of past successes to gauge the company’s track record.

By asking these important questions before choosing a credit card debt consolidation company, you can ensure that you are making an informed decision that will help you achieve financial stability and peace of mind. Take the time to research and compare different companies to find the best fit for your needs.