Best Credit Card Relief Program

Welcome to the ultimate guide on finding the best credit card relief program! If you’re feeling overwhelmed with credit card debt and are looking for ways to lighten the load, you’ve come to the right place. In this article, we’ll explore what credit card relief programs are, how they work, and how to choose the best one for your financial situation. Say goodbye to sleepless nights worrying about debt – help is on the way!

Finding the Right Credit Card Relief Program for You

Are you drowning in credit card debt and looking for relief? Finding the right credit card relief program can be overwhelming, but it’s essential to take the time to research and find the best option for your financial situation. There are various programs available, each with its own benefits and drawbacks, so it’s crucial to understand what you need and what each program offers.

Start by assessing your current financial situation. Take a look at your credit card statements, outstanding balances, interest rates, and monthly payments. This will give you a clear picture of what you owe and how much you can afford to pay each month. It’s important to be honest with yourself and realistic about your financial limitations.

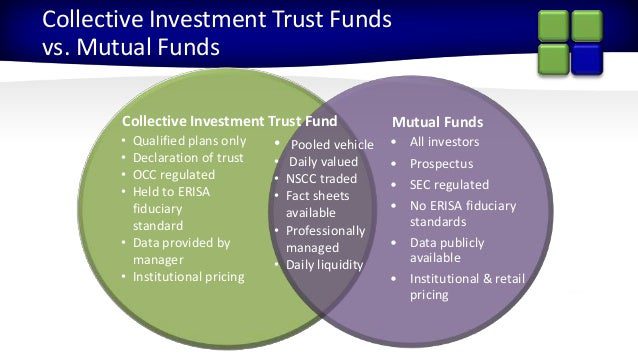

Next, research different credit card relief programs. Some common options include debt consolidation, debt settlement, and credit counseling. Debt consolidation involves combining all of your debts into one loan with a lower interest rate, making it easier to manage your payments. Debt settlement involves negotiating with creditors to settle your debts for less than what you owe. Credit counseling involves working with a counselor to create a budget and payment plan to help you get out of debt.

Consider the pros and cons of each program. Debt consolidation can help simplify your payments and lower your interest rates, but it may not be the best option if you have a low credit score. Debt settlement can help you settle your debts for less than what you owe, but it can also have a negative impact on your credit score. Credit counseling can help you create a plan to pay off your debts, but it may take longer to see results.

Look for a reputable credit card relief program. Before enrolling in any program, make sure to do your research and read reviews from other customers. Avoid programs that promise quick fixes or guaranteed results, as these are often scams. Instead, look for programs that have a proven track record of helping people get out of debt.

Finally, consider consulting with a financial advisor or credit counselor. They can help you assess your financial situation and recommend the best credit card relief program for your needs. They can also provide guidance on how to manage your finances and avoid falling back into debt in the future.

By taking the time to research and find the right credit card relief program for you, you can take control of your finances and work towards a debt-free future. Remember, it’s essential to be patient and persistent, as getting out of debt takes time and effort. With the right program and a solid financial plan, you can finally breathe a sigh of relief knowing that you are on the path to financial freedom.

Understanding the Benefits of Credit Card Relief Programs

When it comes to managing debt and finding ways to overcome financial challenges, credit card relief programs can be a valuable resource. These programs are designed to help individuals who are struggling to make their credit card payments and are looking for a way to reduce their debt burden. But what exactly are the benefits of enrolling in a credit card relief program?

One of the primary benefits of credit card relief programs is that they can help individuals reduce the total amount of debt they owe. Most credit card relief programs work with creditors to negotiate lower interest rates, waive fees, and even reduce the principal balance owed. This can result in significant savings for individuals who are struggling to keep up with their monthly payments.

Furthermore, enrolling in a credit card relief program can also help individuals avoid bankruptcy. Bankruptcy can have long-lasting negative effects on an individual’s credit score and financial future. By enrolling in a credit card relief program, individuals can work towards paying off their debt in a more manageable way, without having to resort to bankruptcy.

Additionally, credit card relief programs can help individuals consolidate their debt into a single, more manageable monthly payment. Instead of having to keep track of multiple credit card payments with varying interest rates and due dates, individuals enrolled in a credit card relief program can make one monthly payment towards their debt. This can help simplify the debt repayment process and make it easier for individuals to stay on track.

Another benefit of credit card relief programs is the potential for improved credit scores. As individuals make consistent payments towards their debt through a credit card relief program, their credit score may begin to improve. This is because making on-time payments and reducing overall debt levels are key factors in determining a person’s credit score. By participating in a credit card relief program, individuals have the opportunity to rebuild their credit and work towards a healthier financial future.

Overall, credit card relief programs offer numerous benefits for individuals who are struggling with credit card debt. From reducing the total amount owed and avoiding bankruptcy to simplifying the repayment process and improving credit scores, these programs can be a valuable tool for individuals looking to take control of their finances and overcome their debt challenges.

Comparing Different Credit Card Relief Programs

When it comes to finding the best credit card relief program, it’s important to compare the different options available to you. There are several factors to consider when evaluating these programs, including the types of debt they cover, the fees involved, and the success rates of each program. Let’s take a closer look at three popular credit card relief programs to help you make an informed decision.

1. Debt Consolidation:

Debt consolidation programs work by combining all of your debts into one loan with a lower interest rate. This can make it easier to manage your payments and potentially save you money in the long run. However, it’s important to be cautious when considering debt consolidation, as some programs may come with high fees or longer repayment terms.

When comparing debt consolidation programs, be sure to look at the interest rates offered, any upfront fees, and the reputation of the company offering the program. Additionally, consider whether the program requires you to put up collateral or have a good credit score to qualify.

2. Debt Settlement:

Debt settlement programs work by negotiating with your creditors to reduce the amount of debt you owe. While this can be an effective way to lower your overall debt burden, it’s important to be aware of the potential risks involved. Some debt settlement programs may result in negative marks on your credit report or require you to stop making payments on your debts, which can lead to legal action from your creditors.

When comparing debt settlement programs, consider the success rates of the program, any fees involved, and the reputation of the company offering the service. Be sure to ask about the potential impact on your credit score and whether the program offers any guarantees for debt reduction.

3. Credit Counseling:

Credit counseling programs offer financial education and budgeting assistance to help you manage your debt more effectively. These programs may also negotiate with your creditors to lower interest rates or waive fees. While credit counseling programs are typically less aggressive than debt consolidation or settlement programs, they can be a good option for those looking to improve their financial literacy and skills.

When comparing credit counseling programs, look for a reputable organization that is accredited by the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). Consider the fees involved, the level of support offered, and whether the program provides ongoing financial education and counseling.

Overall, the best credit card relief program for you will depend on your individual financial situation and goals. Take the time to compare the options available to you and choose a program that aligns with your needs and priorities.

Steps to Take to Enroll in a Credit Card Relief Program

Enrolling in a credit card relief program can be a great way to regain control of your finances and reduce the burden of debt. Here are some steps to take to enroll in a credit card relief program:

1. Research and Compare Programs: The first step in enrolling in a credit card relief program is to research and compare the various programs available. Look for programs that are reputable and have a track record of success in helping individuals manage their debt. Consider the fees and terms of each program to determine which one best fits your financial situation.

2. Gather Necessary Documents: Once you have chosen a credit card relief program to enroll in, you will need to gather the necessary documents to provide to the program. This may include recent credit card statements, income verification documents, and a list of all outstanding debts. Having these documents ready will help expedite the enrollment process.

3. Contact the Program: After gathering all necessary documents, contact the credit card relief program to begin the enrollment process. You may be required to fill out an application or speak with a representative to discuss your financial situation in more detail. Be prepared to provide information about your income, expenses, and debts.

4. Develop a Repayment Plan: Once enrolled in a credit card relief program, you will work with the program to develop a repayment plan that fits your financial situation. This may involve negotiating with creditors to reduce interest rates or create a more manageable repayment schedule. The program will help you create a budget and payment plan to help you pay off your debts efficiently.

5. Stick to the Plan: It is important to stick to the repayment plan developed with the credit card relief program to successfully reduce your debt. Make timely payments and avoid accumulating additional debt while enrolled in the program. Regularly review your progress and make adjustments to your budget as needed.

6. Stay in Communication: Throughout the enrollment process, it is important to stay in communication with the credit card relief program. Update them on any changes to your financial situation and notify them of any challenges you may be facing in making payments. They can provide guidance and support to help you stay on track.

Enrolling in a credit card relief program can be a valuable tool in managing debt and regaining financial stability. By following these steps and staying committed to the program, you can work towards a debt-free future and achieve peace of mind when it comes to your finances.

Avoiding Common Pitfalls in Credit Card Relief Programs

When considering credit card relief programs, it’s important to be aware of the common pitfalls that can occur. By being informed and taking precautions, you can avoid falling into traps that could further worsen your financial situation. Here are some key tips to help you navigate through credit card relief programs successfully:

1. Do Your Research: Before enrolling in any credit card relief program, make sure to thoroughly research the company or organization offering the services. Look for reviews, testimonials, and ratings from previous clients to get an idea of their reputation and success rate. Additionally, check if they are accredited by reputable organizations such as the Better Business Bureau.

2. Beware of Upfront Fees: Be wary of credit card relief programs that require upfront fees before providing any services. Legitimate debt relief companies typically charge fees based on a percentage of the amount they save you, so you should only pay after they have successfully negotiated a settlement for you. If a company asks for payment upfront, it could be a red flag indicating a potential scam.

3. Understand the Terms and Conditions: Before signing any agreements or contracts with a credit card relief program, make sure to read and understand all the terms and conditions. Pay close attention to details such as fees, interest rates, payment schedules, and any potential consequences of non-payment. If there are any unclear or confusing terms, don’t hesitate to ask for clarification from the program provider.

4. Avoid Promises of Instant Debt Relief: Be cautious of credit card relief programs that promise quick and easy solutions to your debt problems. While debt settlement or consolidation can help alleviate your financial burden over time, it’s important to be realistic about the process and timeline involved in achieving debt relief. Avoid programs that guarantee instant debt forgiveness or elimination, as these claims are often too good to be true.

5. Stay Committed to Your Repayment Plan: One common pitfall in credit card relief programs is the temptation to slack off on payments once a settlement has been reached. It’s crucial to stay committed to your agreed-upon repayment plan and continue making consistent payments to avoid any negative consequences. Failing to fulfill your obligations could result in additional fees, penalties, or even legal action from creditors. Remember that debt relief programs are meant to provide support and guidance, but ultimately, it’s up to you to follow through and take responsibility for managing your finances.