Collective Investment Trust Vs Mutual Fund

Choosing Between Collective Investment Trusts and Mutual Funds: What You Need to Know

Hey there, savvy investor! So, you’re ready to take your first steps into the world of investment funds, but you’re not quite sure whether to go with a Collective Investment Trust (CIT) or a Mutual Fund. Don’t worry, we’ve got you covered. In this article, we’ll break down the differences between these two popular options and give you all the information you need to make an informed decision. Let’s dive in and explore the world of CITs and Mutual Funds together!

Structure and Regulation Differences

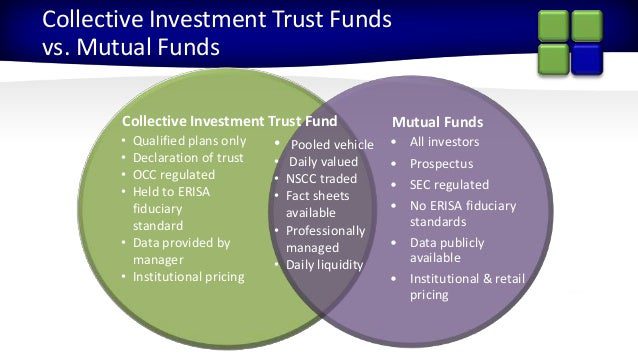

When comparing Collective Investment Trusts (CITs) and Mutual Funds, it is important to understand the differences in their structure and regulation.

CITs are pooled investment funds that are maintained by a bank or trust company for the collective investment of employee benefit plans. These trusts are only available to qualified retirement plans, such as 401(k) plans, and are not open to individual investors. In contrast, Mutual Funds are open to the general public and can be purchased by individual investors through brokerage firms or directly through the fund company.

Another key difference in the structure of CITs and Mutual Funds is the way they are managed. CITs are typically managed by a trust department within a bank or trust company, whereas Mutual Funds are managed by an investment advisory firm. This difference in management structure can impact the investment strategies and fees associated with each type of fund.

Regulation is another important distinction between CITs and Mutual Funds. CITs are regulated by the Office of the Comptroller of the Currency (OCC) and are subject to the Employee Retirement Income Security Act (ERISA). On the other hand, Mutual Funds are regulated by the Securities and Exchange Commission (SEC) under the Investment Company Act of 1940.

One of the main advantages of CITs is that they are not required to register with the SEC, which can result in lower regulatory costs for the fund. However, this exemption from SEC registration also means that CITs are not subject to the same level of disclosure requirements as Mutual Funds. Investors in CITs may have limited access to information about the fund’s holdings, performance, and fees compared to investors in Mutual Funds.

Overall, the differences in structure and regulation between CITs and Mutual Funds can impact the accessibility, management, and disclosure of these investment options. Investors should carefully consider these factors when choosing between the two types of funds to ensure that their investment goals and risk tolerance are aligned with the fund’s characteristics.

Diversification and Investment Choices

When it comes to diversification and investment choices, Collective Investment Trusts (CITs) and Mutual Funds have some key differences that investors need to consider. Diversification is the practice of spreading investments across different asset classes to minimize risk. In the case of CITs, these funds are only available to certain types of institutional investors, such as employee benefit plans. This means that CITs can offer a more specialized range of investment options, which may be tailored to meet the specific needs of these investors. On the other hand, Mutual Funds are open to individual investors and typically offer a more diversified range of investment options, including stocks, bonds, and other securities.

One benefit of CITs when it comes to diversification is that they can be structured to meet the specific investment objectives of the institutional investors that participate in the trust. This could mean that a CIT is designed to focus on a particular sector or industry, which may be appealing to a pension fund looking to hedge against specific market risks. On the other hand, Mutual Funds are often more broadly diversified across various asset classes, which can help individual investors spread their risk more broadly.

When it comes to investment choices, CITs and Mutual Funds also differ in terms of their management and fees. CITs are typically managed by a trust company or a bank, which can result in lower fees compared to Mutual Funds that are managed by investment companies. This can be appealing to institutional investors who are looking to reduce costs and maximize returns. However, Mutual Funds offer individual investors the benefit of professional management and a wider range of investment options, which can be helpful for those who may not have the time or expertise to manage their own investments.

Overall, when considering diversification and investment choices, investors should weigh the benefits and drawbacks of CITs and Mutual Funds to determine which option aligns best with their financial goals and risk tolerance. CITs may offer more specialized investment options for institutional investors looking to tailor their portfolios, while Mutual Funds may provide individual investors with broader diversification and professional management. Ultimately, the decision between CITs and Mutual Funds will depend on the specific needs and preferences of each investor.

Fees and Expense Ratios

One of the key factors to consider when comparing Collective Investment Trusts (CITs) and Mutual Funds is the fees and expense ratios associated with each investment option. Both CITs and Mutual Funds charge fees to cover operating expenses, but the fee structures can vary significantly between the two.

Collective Investment Trusts (CITs) typically have lower fees and expense ratios compared to Mutual Funds. One reason for this is that CITs are generally only available to institutional investors, such as pension funds and retirement plans, which allows them to benefit from economies of scale. This means that the operating costs of running a CIT can be spread out among a larger pool of assets, resulting in lower fees for investors.

On the other hand, Mutual Funds are open to retail investors and have higher overall expenses due to factors such as sales commissions, marketing expenses, and administrative fees. These costs are typically passed on to investors in the form of higher expense ratios. Additionally, Mutual Funds often have higher turnover rates, which can lead to higher trading costs and taxes that are ultimately borne by investors.

When comparing fees and expense ratios between CITs and Mutual Funds, it is important to consider not only the management fees but also any additional costs such as sales loads, redemption fees, and administrative expenses. Investors should be aware of the total cost of ownership when choosing between the two investment options.

Overall, Collective Investment Trusts (CITs) tend to offer lower fees and expense ratios compared to Mutual Funds, making them an attractive option for institutional investors looking to minimize costs and maximize returns. However, it is important for investors to carefully evaluate their investment goals, risk tolerance, and time horizon before making a decision between CITs and Mutual Funds.

Accessibility and Eligibility Criteria

When comparing Collective Investment Trusts and Mutual Funds in terms of accessibility and eligibility criteria, there are some key differences to consider. Collective Investment Trusts, also known as CITs, are typically only available to institutional investors such as retirement plans, endowments, and foundations. This means that individual retail investors may not have access to CITs unless they are offered through their employer-sponsored retirement plan.

On the other hand, Mutual Funds are more widely accessible to individual investors, as they are available for purchase through financial advisors, online platforms, and directly from the fund company. This makes Mutual Funds a popular choice for retail investors looking to diversify their portfolios and achieve their financial goals.

In terms of eligibility criteria, Collective Investment Trusts often have stricter requirements for investors to participate. For example, some CITs may have minimum investment amounts that are out of reach for individual investors. Additionally, CITs may require investors to meet certain accreditation standards or have a specific relationship with the trust sponsor in order to invest.

On the contrary, Mutual Funds typically have lower minimum investment requirements, making them more accessible to a broader range of investors. Additionally, Mutual Funds do not usually have accreditation or relationship requirements, allowing individuals to invest in the fund based on their own financial goals and risk tolerance.

Overall, when considering accessibility and eligibility criteria, Collective Investment Trusts are more tailored towards institutional investors with larger investment requirements and specific relationships with the trust sponsor. On the other hand, Mutual Funds are widely accessible to individual investors with lower minimum investment amounts and fewer eligibility restrictions, making them a popular choice for retail investors seeking diversification and growth in their portfolios.

Performance and Historical Returns

When comparing Collective Investment Trusts (CITs) and Mutual Funds in terms of performance and historical returns, it’s important to consider a few key factors. CITs are typically only available to institutional investors such as 401(k) plans, pension funds, and nonprofit organizations. Mutual funds, on the other hand, are more commonly available to individual retail investors. This accessibility can have an impact on the performance of both types of investment vehicles.

One factor to consider when evaluating performance is the fees associated with each type of investment. CITs generally have lower fees compared to mutual funds, as they are not required to register with the SEC and comply with certain regulatory requirements. These lower fees can have a positive impact on the overall performance of CITs, as they allow for more of the investment returns to be passed on to investors.

Another factor to consider is the investment strategy employed by CITs and mutual funds. CITs are typically managed by trust companies or banks, and their investment strategies tend to be more conservative and focused on long-term growth. Mutual funds, on the other hand, are often managed by investment firms and may have a more aggressive investment approach. This difference in investment strategy can lead to varying levels of performance and historical returns.

One advantage of CITs when it comes to historical returns is their ability to provide more stable and consistent returns over time. Because CITs are only available to institutional investors, they are less susceptible to market fluctuations and investor sentiment. This can result in smoother performance and more reliable historical returns compared to mutual funds, which can be more volatile due to retail investor behavior.

It’s also important to consider the historical returns of both CITs and mutual funds in the context of market conditions and economic cycles. Both types of investment vehicles can experience fluctuations in performance based on factors such as interest rates, inflation, and geopolitical events. Investors should carefully analyze the historical returns of CITs and mutual funds over various market cycles to gain a better understanding of their performance potential.

In conclusion, when evaluating the performance and historical returns of Collective Investment Trusts and Mutual Funds, it’s important to consider factors such as fees, investment strategy, market conditions, and accessibility. While CITs may offer lower fees and more stable returns, mutual funds may provide opportunities for higher returns and greater diversification. Ultimately, the best investment choice will depend on an investor’s individual goals, risk tolerance, and time horizon.

Originally posted 2025-10-03 02:33:45.