Should I Pay Off Student Loans Or Invest

Which Should Come First: Paying Off Student Loans or Investing?

Hey there, have you ever wondered whether you should prioritize paying off your student loans or start investing your money? It’s a common dilemma that many young adults face as they navigate the world of personal finance. Should you focus on eliminating debt first or begin building wealth through investments? Let’s explore the pros and cons of each option to help you make the best decision for your financial future.

Factors to Consider before Making a Decision

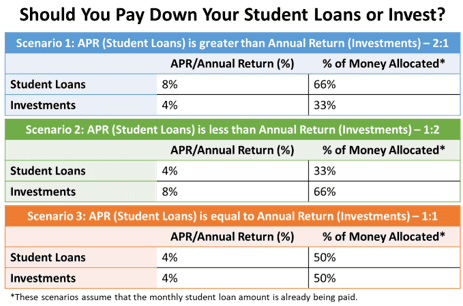

When it comes to deciding whether to pay off your student loans or invest, there are several factors that you should take into consideration. One of the main factors to consider is the interest rates on your student loans. If the interest rate on your loans is high, it may make more financial sense to prioritize paying off your debt before investing. This is because the interest you are accruing on your loans could end up costing you more money in the long run than you would earn through investments. On the other hand, if the interest rate on your loans is low, you may be able to earn a higher return by investing your money instead of paying off your debt.

Another factor to consider is your financial goals and priorities. If you have other financial goals that are more important to you than paying off your student loans, such as saving for a down payment on a house or starting a business, you may want to prioritize those goals over paying off your debt. However, it’s important to consider how your student loans fit into your overall financial picture and to make sure that you are not neglecting your debt in favor of other expenses.

It’s also important to consider your risk tolerance and investment timeline. Investing in the stock market can be a risky venture, and there is always the potential for loss. If you are risk-averse or are saving for a short-term goal, such as buying a car or going on a vacation, you may want to prioritize paying off your student loans before investing. On the other hand, if you have a longer investment timeline and are comfortable with taking on some risk, investing may be a better option for you.

Finally, it’s important to consider the emotional aspect of debt. For some people, the burden of student loan debt can be a source of stress and anxiety, and paying off their debt may bring them peace of mind and a sense of financial freedom. On the other hand, some people may not be as bothered by their debt and may prefer to take a more relaxed approach to paying it off in order to take advantage of potential investment opportunities.

Overall, the decision to pay off your student loans or invest is a personal one that depends on your individual financial situation, goals, and priorities. By carefully considering these factors, you can make an informed decision that aligns with your financial needs and objectives.

Pros and Cons of Paying Off Student Loans Early

When it comes to managing your finances, one common dilemma that many individuals face is whether to pay off their student loans early or to invest their money elsewhere. Here are the pros and cons of paying off student loans early:

Pros:

1. Financial Freedom: One of the biggest benefits of paying off your student loans early is the sense of financial freedom it brings. By eliminating this debt, you free up more of your income to use as you see fit, whether that’s saving for the future, investing in other opportunities, or simply enjoying a higher quality of life without the burden of monthly loan payments.

2. Save on Interest: By paying off your student loans early, you can save a significant amount of money on interest over the life of the loan. This is especially important if you have high-interest loans, as the longer you take to pay them off, the more you will end up paying in interest. By paying them off early, you can reduce the total amount you pay over time.

3. Improve Credit Score: Another benefit of paying off student loans early is the positive impact it can have on your credit score. By reducing your debt-to-income ratio and showing that you are capable of managing your debt responsibly, you can improve your credit score over time, making it easier to qualify for loans and other financial opportunities in the future.

Cons:

1. Miss Out on Investment Opportunities: One of the primary drawbacks of paying off student loans early is that you may miss out on potential investment opportunities that could yield higher returns than the interest savings from paying off your loans. If you have low-interest student loans, it may be more beneficial in the long run to invest your money in other avenues, such as the stock market or real estate.

2. Lost Tax Benefits: Student loan interest is tax-deductible up to a certain amount, depending on your income level. By paying off your student loans early, you may lose out on this tax deduction, which could save you money on your annual tax bill. It’s important to weigh the potential tax benefits of keeping your student loans against the interest savings from paying them off early.

3. Opportunity Cost: Paying off student loans early also comes with an opportunity cost, as the money used to pay off the loans could have been invested elsewhere to potentially earn a higher return. It’s essential to consider the long-term implications of using your money to pay off debt versus investing it for future growth.

In conclusion, the decision to pay off student loans early or invest your money elsewhere ultimately depends on your financial goals, risk tolerance, and individual circumstances. It’s essential to weigh the pros and cons of each option carefully before making a decision that aligns with your long-term financial objectives.

Benefits of Investing for the Future

Investing in the future can provide a sense of security and financial stability. It allows you to build wealth over time and potentially achieve financial independence. By investing early on, you can take advantage of compound interest and grow your money at a faster rate. This means that your initial investment can generate earnings, which are reinvested to generate even more earnings. Over time, this can lead to significant growth in your investment portfolio.

Investing also allows you to diversify your assets and spread out your risk. By investing in a variety of assets, such as stocks, bonds, and real estate, you can reduce the impact of market fluctuations on your overall portfolio. This can help protect your money and ensure that you have a more stable financial future. Additionally, investing in different assets can provide you with a higher return potential, as each asset class may perform differently over time.

Furthermore, investing can help you reach your financial goals. Whether you are saving for retirement, a home, or your children’s education, investing can help you achieve these goals faster. By regularly contributing to your investment portfolio, you can build up your savings and reach your goals sooner than if you relied solely on your income. Investing allows you to grow your money over time and make the most of your financial resources.

In conclusion, investing for the future can offer many benefits, including the potential for growth, diversification of assets, and the ability to reach your financial goals. While paying off your student loans is important, investing in the future can provide you with long-term financial security and help you achieve your financial dreams. Consider discussing your options with a financial advisor to determine the best approach for your unique situation.

Strategies to Balance Loan Repayment and Investing

When faced with the decision of whether to pay off student loans or invest, it can be overwhelming to determine the best course of action. However, there are strategies that can help you balance both loan repayment and investing to ensure you are making smart financial decisions.

One strategy to consider is to prioritize high-interest debt repayment. If your student loans have a high interest rate, it may be beneficial to focus on paying off this debt first. By tackling the debt with the highest interest rate, you can save money in the long run and free up more funds to invest once the debt is paid off.

Another strategy is to take advantage of employer matching contributions. If your employer offers a retirement savings plan with a matching contribution, such as a 401(k), it may be wise to contribute enough to receive the full match before aggressively paying off student loans. This is essentially free money that can help you build your retirement savings while still making progress on your debt repayment.

Additionally, consider creating a budget that allocates a portion of your income towards both loan repayment and investing. By setting a specific amount for each goal, you can ensure that you are making progress on both fronts. This may require some sacrifices in other areas of your budget, but it can help you achieve a balance between paying off debt and building wealth for the future.

Lastly, consider seeking guidance from a financial advisor who can help you create a personalized plan for managing your student loans and investments. A professional can provide valuable insight and expertise to help you make informed decisions that align with your financial goals. They can also help you evaluate your options and determine the best course of action based on your individual circumstances.

By utilizing these strategies, you can effectively balance loan repayment and investing to set yourself on a path towards financial success. Remember that there is no one-size-fits-all answer, so it’s important to evaluate your own situation and goals to determine the best approach for you.

Personal Stories of Individuals Who Faced the Same Dilemma

When it comes to deciding whether to pay off student loans or invest, many individuals find themselves in a tough spot. Let’s take a look at some personal stories of individuals who have faced this dilemma and see how they navigated through it.

1. Sarah, a recent college graduate, was eager to start investing in her future but also had a hefty student loan debt to pay off. After doing some research and consulting with a financial advisor, she decided to prioritize paying off her student loans first. She made a plan to aggressively tackle her debt while still setting aside a small portion of her income for investing. Sarah felt that getting rid of her debt would provide her with more financial freedom in the long run, allowing her to invest more confidently once it was paid off.

2. Michael, on the other hand, was in a more stable financial situation with a good paying job. He had student loans to pay off but also wanted to start investing to build wealth for the future. After weighing his options, Michael decided to split his extra income between paying off his student loans and investing in the stock market. He felt that this balanced approach would allow him to make progress on both fronts without sacrificing one for the other.

3. Jen had always dreamed of traveling the world but was burdened by her student loan debt. She struggled with the decision of whether to use her extra funds to pay off her loans faster or to save up for her dream travels. Eventually, Jen decided to prioritize paying off her student loans first and then start saving for travel once the debt was gone. It was a tough decision for her, but she knew that being debt-free would give her the financial freedom to pursue her passions without any added stress.

4. Tom had a different approach to the dilemma of student loan debt versus investing. He believed in the power of compound interest and decided to invest his extra money in the stock market while making minimum payments on his student loans. Tom felt that by investing early and consistently, he could potentially earn more returns than the interest he was paying on his student loans. This strategy worked well for Tom as he saw his investments grow over time, ultimately helping him pay off his student loans faster.

5. Laura found herself torn between paying off her student loans and investing in her passion project. She had a significant amount of debt to pay off but also wanted to pursue her dream of starting a small business. After much contemplation, Laura decided to prioritize paying off her student loans first to reduce financial stress and free up more funds for her business venture. Once her debt was paid off, Laura was able to focus on building her business without the added pressure of student loan payments.

Originally posted 2025-10-03 02:35:08.