The Best Credit Card Consolidation Loan

Welcome, dear readers, are you feeling overwhelmed by multiple credit card debts? Don’t worry, because we are here to help! In this article, we will discuss the top credit card consolidation loan options to help you manage and pay off your debts more efficiently. By consolidating your debts into one loan with a lower interest rate, you can save money and simplify your monthly payments. Let’s explore the best options available to you!

Understanding Credit Card Consolidation Loans

Credit card consolidation loans are a type of personal loan that can help you manage and pay off multiple high-interest credit card debts. Instead of making multiple payments to different credit card companies each month, a consolidation loan allows you to combine all of your debts into one single monthly payment. This can make it easier to keep track of your finances and potentially save money on interest payments.

When you take out a credit card consolidation loan, the lender will pay off your existing credit card debts on your behalf. In return, you will need to repay the loan amount, usually with a fixed interest rate and set repayment term. By consolidating your credit card debts, you may be able to secure a lower interest rate than what you are currently paying on your credit cards, which can save you money in the long run.

One of the key benefits of credit card consolidation loans is the potential to simplify your finances. Instead of dealing with multiple due dates and varying interest rates, you only have one loan to manage. This can make it easier to budget and plan for your monthly expenses, as you will know exactly how much you need to set aside for your loan repayment each month. Additionally, consolidating your debts can help improve your credit score by reducing your credit utilization ratio and showing that you are actively working to pay off your debts.

It is important to carefully consider your financial situation before taking out a credit card consolidation loan. While it can be a useful tool for managing debt, it is not a solution for everyone. Make sure to compare loan offers from different lenders to find the best interest rate and terms for your needs. Additionally, be sure to read the fine print and understand any fees or penalties associated with the loan before signing on the dotted line.

Overall, credit card consolidation loans can be a helpful tool for getting out of debt and improving your financial health. By combining your credit card debts into one manageable payment, you can simplify your finances and potentially save money on interest payments. Just be sure to do your research and choose a loan that fits your budget and financial goals.

Benefits of Consolidating Credit Card Debt

Consolidating credit card debt can be a smart move for those looking to simplify their finances and save money in the long run. By consolidating multiple credit card debts into one loan, individuals can benefit in a variety of ways.

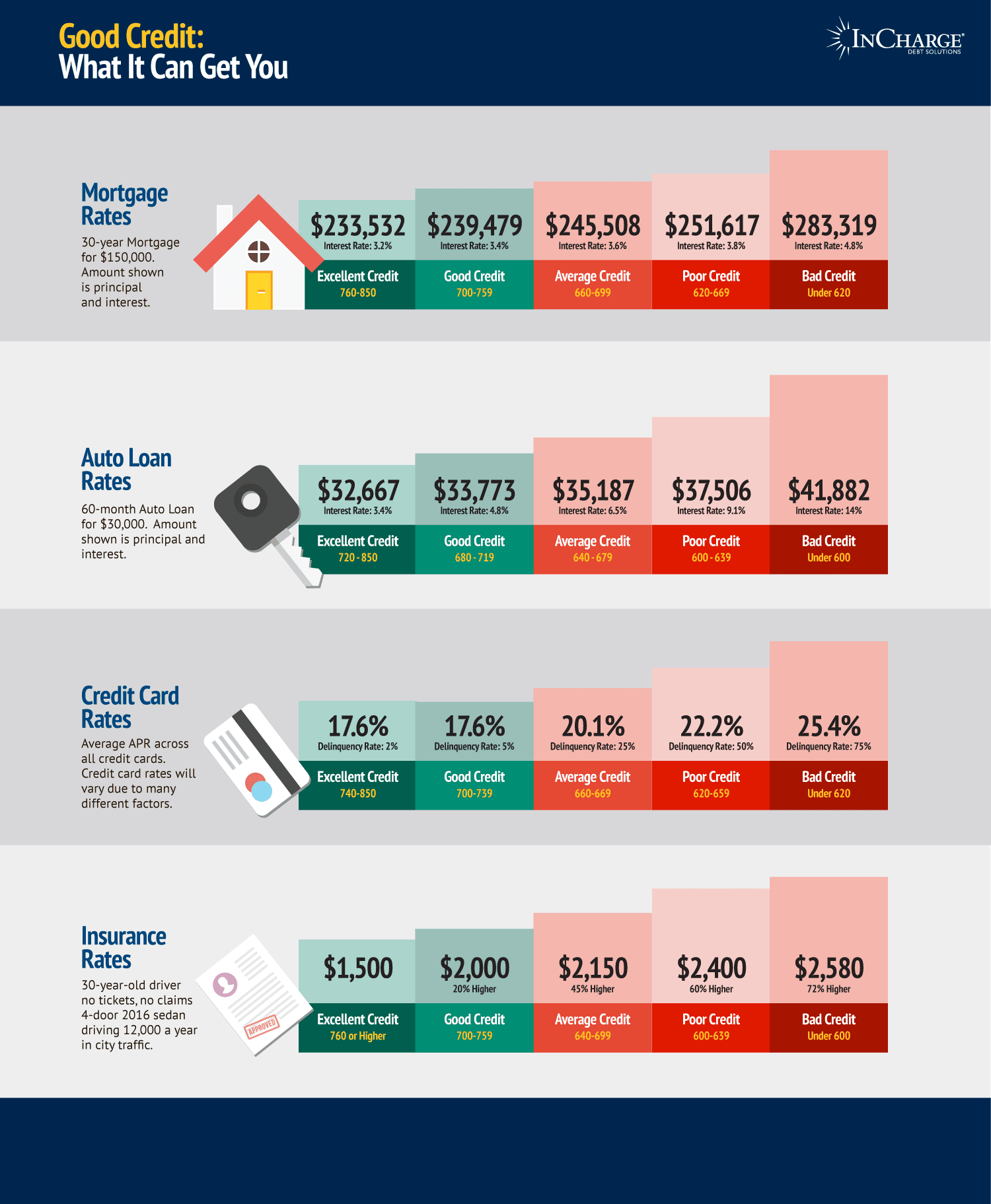

One of the biggest benefits of consolidating credit card debt is the potential to lower your overall interest rate. Credit cards typically come with high interest rates, especially if you have a history of late payments or high balances. By consolidating your debts into a single loan with a lower interest rate, you can save money on interest payments over time.

Consolidating credit card debt can also make it easier to manage your monthly payments. Instead of keeping track of multiple due dates and minimum payments, you only have to worry about one loan payment each month. This can help simplify your finances and reduce the chances of missing a payment and incurring late fees.

Another benefit of consolidating credit card debt is the potential to improve your credit score. When you consolidate your debts, you may be able to lower your credit utilization ratio, which is the amount of credit you are using compared to the total credit available to you. A lower credit utilization ratio can have a positive impact on your credit score, making it easier to qualify for future loans and credit cards with better terms.

Consolidating credit card debt can also give you the opportunity to create a more structured debt repayment plan. Instead of making minimum payments on multiple credit cards, you can focus on paying off one loan with a set repayment schedule. This can help you stay on track with your debt repayment goals and avoid the temptation of racking up more debt on your credit cards.

Additionally, consolidating credit card debt can provide peace of mind and reduce financial stress. Juggling multiple credit card payments and high interest rates can be overwhelming, but with a consolidation loan, you can have a clear plan for paying off your debts and getting back on track financially.

In conclusion, consolidating credit card debt can offer a variety of benefits, including lower interest rates, simplified payments, improved credit score, structured repayment plan, and reduced financial stress. If you are struggling with credit card debt, consider exploring your options for consolidating your debts and taking control of your finances.

How to Qualify for a Credit Card Consolidation Loan

Qualifying for a credit card consolidation loan can vary depending on the lender and your financial situation. Here are some general guidelines to help you determine if you qualify for a credit card consolidation loan:

1. Good Credit Score: One of the most important factors in qualifying for a credit card consolidation loan is having a good credit score. Lenders typically look for a credit score of 600 or higher, although some may require a higher score for the best interest rates. Your credit score is a reflection of your credit history and shows lenders how responsible you are with managing your finances. If your credit score is below 600, you may still qualify for a consolidation loan, but you may end up with higher interest rates.

2. Stable Income: Lenders want to see that you have a stable source of income to ensure that you can make your monthly loan payments. Having a steady job or income stream can increase your chances of qualifying for a credit card consolidation loan. Lenders may ask for proof of income, such as pay stubs or tax returns, to verify your financial stability.

3. Low Debt-to-Income Ratio: Your debt-to-income ratio is another important factor that lenders consider when deciding whether to approve you for a consolidation loan. This ratio is calculated by dividing your total monthly debt payments by your gross monthly income. Ideally, lenders prefer to see a debt-to-income ratio of 50% or lower. A lower ratio shows that you have enough income to comfortably make your loan payments, while a higher ratio may indicate that you could struggle to repay the loan.

4. Collateral: Some lenders may require collateral, such as a home or car, to secure a credit card consolidation loan. Collateral provides the lender with a guarantee that they will be able to recoup their losses if you default on the loan. If you have valuable assets that you are willing to use as collateral, this can increase your chances of qualifying for a consolidation loan.

5. Good Payment History: Lenders also look at your payment history to determine if you are a responsible borrower. Making on-time payments on your credit cards and other debts shows lenders that you are reliable and can be trusted to repay a consolidation loan. Conversely, a history of late payments or defaults can make it more difficult to qualify for a loan.

Ultimately, qualifying for a credit card consolidation loan will depend on a variety of factors, including your credit score, income, debt-to-income ratio, and payment history. By understanding what lenders look for, you can improve your chances of getting approved for a consolidation loan and taking steps towards becoming debt-free.

Top Lenders for Credit Card Consolidation Loans

When it comes to finding the best credit card consolidation loan, you want to make sure you are working with a reputable lender that offers competitive rates and terms. Here are some top lenders that are known for their credit card consolidation loan offerings:

1. SoFi – SoFi is a popular choice for credit card consolidation loans due to their low interest rates and flexible repayment options. They also have a user-friendly online application process that makes it easy to apply for a loan and manage your payments.

2. LendingClub – LendingClub is another top lender for credit card consolidation loans. They offer fixed-rate loans with repayment terms ranging from 36 to 60 months, making it easier for borrowers to budget their monthly payments. LendingClub also has a quick approval process, so you can get the funds you need in a timely manner.

3. Discover Personal Loans – Discover is known for their excellent customer service and competitive rates on personal loans, including credit card consolidation loans. They have a variety of loan options available to meet your specific needs, and you can pre-qualify for a loan without impacting your credit score.

4. Prosper – Prosper is a peer-to-peer lending platform that connects borrowers with individual investors. They offer credit card consolidation loans with fixed rates and terms ranging from 36 to 60 months. Prosper also has a simple online application process and competitive rates, making it a top choice for borrowers looking to consolidate their credit card debt.

By considering these top lenders for credit card consolidation loans, you can find a loan that meets your needs and helps you pay off your credit card debt more efficiently. Remember to compare rates and terms from multiple lenders to ensure you are getting the best deal possible.

Tips for Successfully Managing a Credit Card Consolidation Loan

Managing a credit card consolidation loan requires careful planning and discipline. Here are some tips to help you successfully manage your loan:

1. Create a Budget: The first step in successfully managing a credit card consolidation loan is to create a budget. Take a look at your income and expenses to determine how much you can afford to pay towards your loan each month. Make sure to prioritize your loan payments to avoid falling behind.

2. Stick to the Payment Schedule: Once you have a budget in place, make sure to stick to the payment schedule provided by your lender. Missing payments can result in late fees and further damage to your credit score. Set up automatic payments if possible to ensure you never miss a due date.

3. Avoid Using Credit Cards: To prevent further debt from accumulating, avoid using your credit cards while you are paying off your consolidation loan. Cut up or hide your cards to resist the temptation to overspend and undo the progress you have made in consolidating your debt.

4. Communicate with Your Lender: If you are struggling to make your loan payments, don’t hesitate to reach out to your lender. They may be able to work with you to adjust your payment schedule or offer other solutions to help you stay on track. Ignoring the problem will only make it worse in the long run.

5. Build an Emergency Fund: One key to successfully managing a credit card consolidation loan is to have an emergency fund in place. Unexpected expenses can derail your progress if you don’t have savings to cover them. Aim to save at least three to six months’ worth of living expenses in an easily accessible account to provide a financial safety net.

By following these tips, you can successfully manage your credit card consolidation loan and work towards becoming debt-free. Remember that it is important to stay focused on your goal and make smart financial decisions to ultimately achieve financial freedom.