Understanding Business Term Loans Online

Welcome to our guide on understanding business term loans online! If you’re a small business owner looking to expand or cover unexpected expenses, term loans can be a great option. These loans offer a lump sum of money that is repaid over a set period of time, with a fixed or variable interest rate. In this article, we’ll explore the ins and outs of business term loans, how to apply for them online, and what to consider before taking one out. Let’s dive in!

Advantages of Business Term Loans Online

Business term loans are a popular choice for entrepreneurs looking to finance their business operations. With the rise of online lending platforms, getting a business term loan online has never been easier. There are several advantages to obtaining a business term loan online that make it a convenient and efficient option for small business owners.

One of the key advantages of getting a business term loan online is the speed and convenience of the application process. Traditional bank loans can take weeks or even months to process, with a lot of paperwork and red tape involved. Online lenders, on the other hand, have streamlined their application processes to make it quick and easy for borrowers to apply for a loan. With just a few clicks, you can fill out an online application form and submit the necessary documents, saving you time and hassle.

Another advantage of business term loans online is the access to a wider range of lenders. When you apply for a loan through a traditional bank, you are limited to the loan products they offer. With online lending platforms, you have access to a network of lenders who specialize in providing business term loans to small businesses. This means you can compare offers from multiple lenders and choose the one that best suits your financing needs.

Online business term loans also offer greater flexibility in terms of loan amounts and repayment terms. Traditional bank loans typically have strict requirements for loan amounts and repayment schedules, which may not always align with your business’s needs. Online lenders understand that each business is unique and may require different financing options. They offer a variety of loan amounts and repayment terms to accommodate a wide range of business types and sizes.

Business term loans online also provide transparency and clarity in the loan terms and conditions. Online lenders are required to disclose all fees, interest rates, and repayment terms upfront, so you know exactly what you are getting into before you sign on the dotted line. This transparency gives you peace of mind knowing that there are no hidden surprises or unexpected costs down the road.

Lastly, business term loans online offer competitive interest rates and fees. Online lenders have lower overhead costs compared to traditional banks, allowing them to offer lower interest rates and fees to borrowers. This means you can save money on interest payments and fees over the life of the loan, making it a cost-effective financing option for your business.

In conclusion, business term loans online offer numerous advantages for small business owners, including speed and convenience, access to a wider range of lenders, flexibility in loan amounts and repayment terms, transparency in loan terms, and competitive interest rates and fees. If you are in need of financing for your business, consider applying for a business term loan online to take advantage of these benefits.

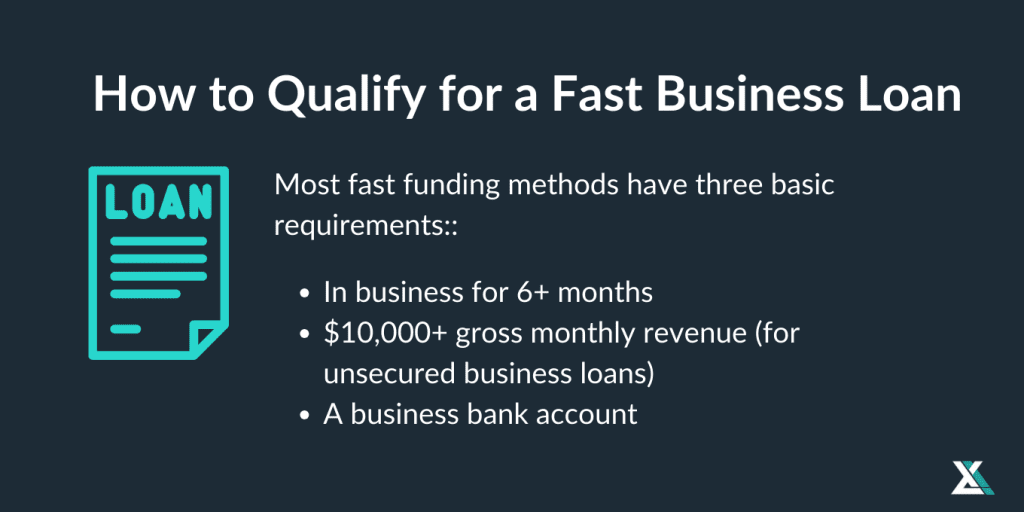

How to Qualify for Business Term Loans Online

When seeking a business term loan online, there are certain qualifications that lenders will typically look for before approving your application. It is important to understand these requirements to increase your chances of getting the funding you need.

One of the main factors that lenders will consider when reviewing your application is your credit score. A good credit score is typically a key requirement for qualifying for a business term loan online. Lenders will use your credit score to assess your creditworthiness and determine the interest rate you will be charged on the loan. A higher credit score generally indicates that you are a low-risk borrower and are more likely to make timely payments on the loan.

In addition to your credit score, lenders will also look at your business’s financial history. This may include reviewing your business’s revenue, cash flow, and profitability. Lenders want to see that your business is financially stable and has the ability to repay the loan in a timely manner. Providing accurate and up-to-date financial information will help to support your application and increase your chances of getting approved for a business term loan online.

Another important factor that lenders will consider is your business’s age and industry. Some lenders may have specific requirements for the age of your business and the industry you operate in. For example, newer businesses may have a harder time qualifying for a business term loan online, as they may not have a proven track record of financial stability. Additionally, some lenders may have restrictions on lending to businesses in certain industries that are considered high-risk.

Collateral is another consideration that lenders may take into account when reviewing your application for a business term loan online. Collateral is an asset that you pledge to secure the loan, such as real estate, equipment, or inventory. Having collateral can help to reduce the lender’s risk and increase your chances of getting approved for the loan. However, not all business term loans require collateral, so it is important to check the lender’s requirements before applying.

Finally, lenders will also consider your debt-to-income ratio when evaluating your application for a business term loan online. Your debt-to-income ratio is a measure of how much of your monthly income goes towards paying off debts. Lenders want to see that you have enough income to cover your existing debts as well as the new loan payments. A lower debt-to-income ratio demonstrates to lenders that you have the financial capacity to repay the loan.

By understanding these key factors and taking steps to strengthen your application, you can improve your chances of qualifying for a business term loan online. Make sure to gather all the necessary documents and information before applying, and be prepared to answer any questions that the lender may have about your business’s financial situation. With the right qualifications and preparation, you can secure the funding you need to help your business grow and succeed.

Top Lenders for Business Term Loans Online

When it comes to finding the right lender for your business term loan online, there are several options to consider. Each lender has its own unique offerings and requirements, so it’s important to do your research and find the best fit for your business needs. Here are three of the top lenders that offer business term loans online:

1. OnDeck: OnDeck is a well-known online lender that specializes in small business loans. They offer term loans ranging from $5,000 to $250,000 with repayment terms of up to 18 months. OnDeck has a streamlined online application process and quick funding, making it a popular choice for small businesses in need of fast financing.

2. Funding Circle: Funding Circle is another top lender for business term loans online. They offer loans ranging from $25,000 to $500,000 with repayment terms of up to five years. Funding Circle is known for its competitive interest rates and flexible repayment options, making it a great choice for businesses looking for larger loan amounts and longer repayment terms.

3. Kabbage: Kabbage is a leading online lender that offers business term loans ranging from $1,000 to $250,000 with repayment terms of up to 18 months. Kabbage is known for its fast approval process and flexible credit requirements, making it a great option for businesses with less-than-perfect credit. In addition to term loans, Kabbage also offers lines of credit for businesses in need of ongoing financing.

Overall, when looking for a lender for your business term loan online, it’s important to consider factors such as loan amounts, repayment terms, interest rates, and eligibility requirements. By doing your research and comparing your options, you can find the best lender that meets your business needs and helps you achieve your financial goals.

Tips for Comparing Business Term Loans Online

When it comes to comparing business term loans online, there are several key factors to consider to ensure that you are making the best decision for your company. Here are some tips to help you navigate the process:

1. Interest Rates: One of the most important factors to consider when comparing business term loans online is the interest rate. Be sure to carefully review the interest rates offered by various lenders and compare them to find the best option for your business. Keep in mind that lower interest rates can save you money in the long run.

2. Loan Terms: Another important factor to consider is the loan terms. Different lenders may offer different repayment schedules, so be sure to carefully review the terms of each loan to ensure that they align with your business’s financial goals. Look for flexible repayment options that suit your cash flow needs.

3. Fees and Closing Costs: In addition to interest rates and loan terms, it is important to consider any fees or closing costs associated with the business term loan. These additional costs can vary greatly between lenders, so be sure to factor them into your overall comparison of loan options.

4. Customer Reviews and Reputation: While researching business term loans online, take the time to read customer reviews and assess the reputation of the lenders you are considering. Look for feedback from other business owners who have worked with the lender to get a sense of the level of customer service and satisfaction they provide. A reputable lender with positive reviews is more likely to provide a smooth and positive borrowing experience.

5. Application Process: Consider the ease and convenience of the application process when comparing business term loans online. Look for lenders that offer a streamlined and efficient application process, as this can save you time and hassle. Some lenders may even offer pre-approval or instant decision options to help expedite the process.

6. Funding Speed: Lastly, consider the speed at which the lender can fund your business term loan. Some lenders may be able to provide funds quickly, which can be crucial if you need capital urgently for a new project or opportunity. Look for lenders that can offer quick funding turnaround times to meet your business needs.

By taking the time to carefully compare business term loans online using these tips, you can make an informed decision that best suits your company’s financial needs and goals. Remember to consider all factors, including interest rates, loan terms, fees, customer reviews, application process, and funding speed, to ensure that you choose the right loan for your business.

Common Mistakes to Avoid When Applying for Business Term Loans Online

When it comes to applying for business term loans online, there are several common mistakes that applicants should be aware of in order to increase their chances of approval. Knowing what to avoid can save time and frustration during the loan application process. Here are some key mistakes to steer clear of:

Applying for the Wrong Loan Amount

One of the most common mistakes when applying for a business term loan online is requesting the wrong loan amount. It’s essential to carefully calculate how much funding your business needs before filling out the application. Asking for too little money can leave your business underfunded and struggling to meet its financial needs. On the other hand, requesting too much money can lead to a denial of your loan application. Take the time to assess your business’s financial situation and determine the appropriate loan amount before applying.

Not Checking Your Credit Score

Another mistake that applicants often make is failing to check their credit score before applying for a business term loan online. Your credit score plays a crucial role in the loan approval process, as lenders use it to assess your creditworthiness. A low credit score can result in higher interest rates or even a denial of your loan application. Before applying for a business term loan, it’s important to review your credit report and take steps to improve your score if necessary.

Providing Inaccurate or Incomplete Information

When filling out the application for a business term loan online, it’s crucial to provide accurate and complete information. Lenders rely on the information you provide to make their lending decisions, so any inaccuracies or omissions could result in a denial of your application. Be sure to double-check all of the information you provide, including your business’s financial statements, before submitting your application.

Not Researching Lenders

Another common mistake when applying for business term loans online is not taking the time to research potential lenders. Each lender has different eligibility requirements, interest rates, and repayment terms, so it’s essential to compare multiple lenders before choosing one to apply to. Researching lenders can help you find the best loan terms for your business and increase your chances of approval.

Applying to Multiple Lenders Simultaneously

While it may be tempting to apply to multiple lenders at once to increase your chances of approval, this can actually hurt your credit score and decrease your chances of securing a business term loan. Each time you apply for a loan, a hard inquiry is made on your credit report, which can lower your score. Instead of applying to multiple lenders simultaneously, take the time to research and carefully select one or two lenders that best suit your business’s needs.

By avoiding these common mistakes when applying for business term loans online, you can increase your chances of approval and secure the funding your business needs to succeed.