What Is A Collective Investment Trust

Understanding Collective Investment Trusts: What You Need to Know

Welcome, curious investor! Have you heard of Collective Investment Trusts (CITs) and wondered what they are all about? Well, you’ve come to the right place. In this article, we will delve into the world of CITs and break down everything you need to know about them. From how they work to the benefits they offer, we will explore it all. So sit back, relax, and let’s unravel the mystery of CITs together.

How Does a Collective Investment Trust Work?

So, you might be wondering, what exactly is a Collective Investment Trust (CIT) and how does it operate? Well, let me break it down for you in simple terms. A CIT is a pooled investment vehicle that is collectively managed by a bank or trust company to benefit multiple individuals or institutions. Essentially, it’s like a big pot of money that is invested in various securities such as stocks, bonds, or other assets.

Here’s how it works: When you invest in a CIT, your money is combined with the funds of other investors to create a larger pool of assets. This pool of assets is then managed by a professional investment manager who makes decisions on behalf of all the investors in the trust. The investment manager is responsible for selecting and managing the investments in the trust to achieve the stated investment objectives.

One of the key benefits of investing in a CIT is that it allows for greater diversification. By pooling your money with other investors, you can access a diversified portfolio of investments that you might not be able to access on your own. This diversification can help reduce risk and potentially improve returns over the long term.

Another advantage of CITs is that they are typically more cost-effective than other investment options such as mutual funds. Because CITs are not regulated by the SEC, they do not have to comply with the same disclosure requirements as mutual funds. This can result in lower fees for investors, which can have a positive impact on investment returns.

Additionally, CITs are often only available to institutional investors such as pension funds, foundations, and endowments. This means that retail investors like you and me may not have access to these investment options unless they are offered through an employer-sponsored retirement plan. However, some CITs are now becoming more accessible to individual investors through financial advisors and retirement platforms.

In conclusion, a Collective Investment Trust is a unique investment vehicle that offers investors the opportunity to pool their funds together to access a diversified portfolio of investments. It is a cost-effective way to invest in a professionally managed portfolio and can provide benefits such as greater diversification and potentially lower fees. While not available to all investors, CITs can be a valuable addition to your investment portfolio if you have the opportunity to invest in them.

Benefits of Investing in a Collective Investment Trust

When it comes to investing, there are a multitude of options available to individuals looking to grow their wealth. One option that has gained popularity in recent years is investing in a Collective Investment Trust (CIT). A CIT is a pooled investment vehicle that is collectively managed by a group of trustees or fund managers. This type of trust combines the assets of multiple investors to create a larger, more diversified portfolio. There are several benefits to investing in a CIT, including diversification, lower fees, and increased access to professional fund management.

One of the key benefits of investing in a Collective Investment Trust is diversification. By pooling resources with other investors, individuals are able to gain exposure to a wider range of assets than they would be able to on their own. This helps reduce the risk of having all of their eggs in one basket and can lead to more stable returns over time. Diversification is a fundamental principle of investing, and a CIT provides an easy way to achieve this without having to constantly monitor and adjust individual holdings.

In addition to diversification, investing in a CIT often comes with lower fees compared to other investment options. Because a CIT pools the assets of multiple investors, the overall cost of managing the trust is spread out among a larger group of people. This can result in lower management fees and expenses, which can have a significant impact on the overall performance of the investment. Lower fees mean more of the investment returns stay in the pockets of investors, allowing them to benefit from compounding growth over time.

Another advantage of investing in a Collective Investment Trust is the access to professional fund management. CITs are typically managed by experienced professionals who have the knowledge and expertise to make sound investment decisions on behalf of the trust. This can be especially beneficial for investors who may not have the time or expertise to manage their own investments effectively. Professional fund managers can analyze market trends, research potential opportunities, and actively manage the trust to optimize returns for investors.

Overall, investing in a Collective Investment Trust can offer individuals a convenient way to achieve diversification, lower fees, and access to professional fund management. By pooling resources with other investors, individuals can benefit from a more diversified portfolio, lower costs, and the expertise of experienced fund managers. For those looking to grow their wealth over the long term, a CIT can be a valuable investment option to consider.

Key Differences Between a Collective Investment Trust and Mutual Fund

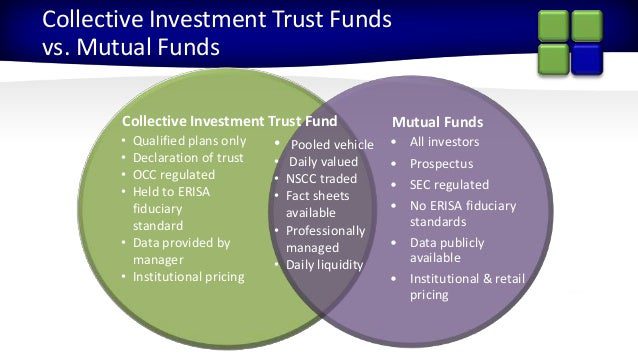

When it comes to understanding the key differences between a collective investment trust and a mutual fund, it’s important to know that both investment vehicles have their own unique characteristics and benefits. Here are some key differences to consider:

1. Regulation: One of the main differences between a collective investment trust (CIT) and a mutual fund is the regulatory oversight they fall under. CITs are typically regulated by the Office of the Comptroller of the Currency (OCC) or the Securities and Exchange Commission (SEC) if they are publicly offered, while mutual funds are regulated by the SEC under the Investment Company Act of 1940.

2. Accessibility: CITs are typically only available to institutional investors, such as retirement plans, pension funds, and nonprofits. On the other hand, mutual funds are more commonly available to individual investors through financial advisors, banks, and brokerage firms. This accessibility difference can play a significant role in determining which investment vehicle is right for you based on your investor status.

3. Fees and Expenses: Another key difference between CITs and mutual funds is the structure of fees and expenses. CITs tend to have lower operating expenses compared to mutual funds. This is mainly due to the fact that CITs are offered to institutional investors, who benefit from economies of scale. Mutual funds, which are often marketed to retail investors, may have higher expenses such as sales charges (loads) and 12b-1 fees. Additionally, mutual funds may have higher management fees compared to CITs. These fee differences can impact the overall performance and returns of each investment vehicle.

4. Investment Minimums: Generally, CITs have higher minimum investment requirements compared to mutual funds. Since CITs are designed for institutional investors, they typically require a higher initial investment amount to participate. Mutual funds, on the other hand, are often more accessible to individual investors with lower minimum investment thresholds. This difference in investment minimums can influence who has access to each investment vehicle based on their financial resources.

5. Transparency: CITs are not required to disclose their holdings or performance data to the general public, as they are not regulated by the SEC. This lack of transparency can be seen as a disadvantage for investors who prefer full disclosure of their investments. Mutual funds, on the other hand, are required to regularly disclose their holdings and performance information to the public, providing greater transparency for investors.

In conclusion, while both collective investment trusts and mutual funds offer investors the opportunity to diversify their portfolios and access professional management, there are distinct differences between the two vehicles in terms of regulation, accessibility, fees and expenses, investment minimums, and transparency. It’s important to consider these differences and how they align with your investment goals and preferences when deciding which investment vehicle is right for you.

Factors to Consider Before Investing in a Collective Investment Trust

When considering investing in a collective investment trust, there are several factors that investors should take into account before making a decision. These factors can help investors determine whether a collective investment trust is the right investment vehicle for their financial goals and risk tolerance. Here are some key factors to consider before investing in a collective investment trust:

1. Investment Objective: One of the first factors to consider before investing in a collective investment trust is the investment objective of the trust. Investors should determine whether the trust’s investment objective aligns with their own financial goals and risk tolerance. For example, if an investor is seeking long-term capital growth, they may want to choose a trust that focuses on growth stocks.

2. Risk Level: Another important factor to consider is the risk level of the collective investment trust. Investors should assess their risk tolerance and choose a trust that matches their risk profile. Some trusts may be more conservative and focus on preserving capital, while others may be more aggressive and seek higher returns through riskier investments.

3. Fees and Expenses: Investors should also consider the fees and expenses associated with investing in a collective investment trust. These costs can vary depending on the trust and can have a significant impact on the overall return on investment. It is important for investors to carefully review the fee structure of the trust and understand how these fees will affect their returns.

4. Track Record: Before investing in a collective investment trust, investors should examine the trust’s track record. This includes looking at the historical performance of the trust, including its returns over time and how it has performed in different market conditions. A track record can provide valuable insights into the trust’s investment strategy and the skills of the trust’s management team.

Additionally, investors may want to consider the trust’s consistency of performance over time and whether it has been able to meet its stated investment objectives. While past performance is not indicative of future results, a strong track record can provide investors with confidence in the trust’s ability to generate returns over the long term.

In conclusion, there are several factors to consider before investing in a collective investment trust. By carefully assessing the investment objective, risk level, fees and expenses, and track record of the trust, investors can make informed decisions about whether a collective investment trust is the right investment vehicle for their financial goals and risk tolerance.

Regulation and Oversight of Collective Investment Trusts

Collective Investment Trusts (CITs) are investment vehicles that pool together assets from multiple investors to create a larger, diversified portfolio. These trusts are regulated and overseen by various governmental bodies and agencies to ensure transparency, compliance, and investor protection. The regulation and oversight of CITs play a crucial role in maintaining the trust and confidence of investors in these investment vehicles.

One of the key regulators of CITs in the United States is the Office of the Comptroller of the Currency (OCC). The OCC is responsible for supervising national banks and federal savings associations, including those that serve as trustees for CITs. The OCC’s oversight of CITs includes ensuring that the trusts comply with applicable laws and regulations, such as the Employee Retirement Income Security Act (ERISA) and the Investment Company Act of 1940.

In addition to federal oversight, CITs are also subject to regulation by state securities regulators. Each state has its own set of rules and regulations governing the operation of CITs within its jurisdiction. State securities regulators play a vital role in overseeing CITs to protect investors from fraud, abuse, and misconduct.

Another important aspect of the regulation and oversight of CITs is the role of the trustee. The trustee of a CIT is typically a bank or trust company that is responsible for managing the assets of the trust in accordance with its investment objective and policies. Trustees are required to adhere to strict fiduciary standards and are subject to regulatory oversight to ensure that they act in the best interests of the trust and its beneficiaries.

Regulators also require CITs to provide regular disclosures to investors about the fund’s investment strategy, performance, fees, and risks. These disclosures play a crucial role in helping investors make informed decisions about their investments and hold trustees and asset managers accountable for their actions.

Overall, the regulation and oversight of CITs are essential to ensuring the integrity and stability of these investment vehicles. By holding trustees and asset managers accountable, protecting investors from fraud and abuse, and promoting transparency and compliance, regulators play a vital role in maintaining the trust and confidence of investors in CITs.

Originally posted 2025-10-03 02:36:26.