What Is The Best Credit Card Debt Consolidation Program

What Is the Best Credit Card Debt Consolidation Program

Welcome, reader! If you’re feeling overwhelmed by credit card debt and looking for a way to simplify your payments, you may be considering a credit card debt consolidation program. With so many options available, it can be difficult to determine which program is the best fit for your financial situation. To help you make an informed decision, we’ve put together a guide to the best credit card debt consolidation programs on the market. By the end of this article, you’ll have a clearer understanding of the options available to you and be one step closer to achieving financial freedom.

Evaluating Your Financial Situation

Before considering a credit card debt consolidation program, it is important to thoroughly evaluate your financial situation. Start by gathering all of your credit card statements and any other debts you may have, such as personal loans or medical bills. Take note of the total amount you owe, the interest rates on each debt, and the minimum monthly payments required. This will give you a clear picture of your current financial obligations and help you determine whether a debt consolidation program is the right solution for you.

Next, take a close look at your monthly income and expenses. Calculate how much money you bring in each month from your job, side gigs, or any other sources of income. Then, make a list of all your monthly expenses, including rent or mortgage, utilities, groceries, transportation, and any other necessary costs. This will help you understand how much money you have leftover each month after covering your essential expenses.

Once you have a good understanding of your total debts and monthly income, it’s time to assess your financial goals and priorities. Consider what you hope to achieve by consolidating your credit card debt – whether it’s reducing your monthly payments, lowering your interest rates, or simply simplifying your finances. Think about how a debt consolidation program fits into your long-term financial plans and whether it aligns with your goals.

Additionally, take a honest look at your spending habits and financial behavior. Are you consistently making late payments on your credit cards? Are you constantly using credit cards to cover everyday expenses? These patterns may indicate underlying issues with budgeting and money management that a debt consolidation program alone may not solve. It’s important to address these behaviors in conjunction with a debt consolidation program to prevent falling back into debt in the future.

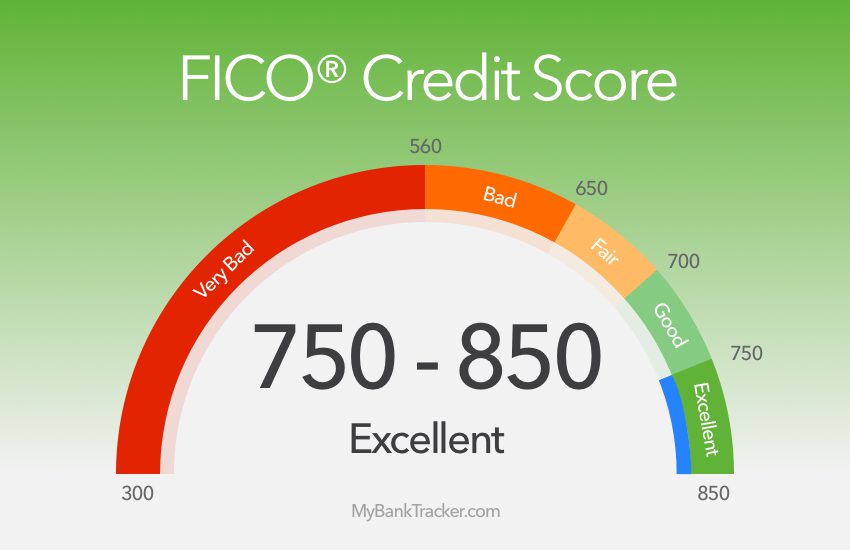

Finally, consider your credit score and the impact that consolidating your credit card debt may have on it. While a debt consolidation program can help you pay off your debts more efficiently, it may also temporarily lower your credit score. Make sure you understand the potential consequences of consolidating your debt on your credit score and have a plan in place to rebuild it over time.

By thoroughly evaluating your financial situation, you can make an informed decision about whether a credit card debt consolidation program is right for you. Taking the time to assess your debts, income, expenses, goals, and behaviors will help you determine the best course of action to achieve financial stability and freedom.

Understanding Different Consolidation Options

When it comes to consolidating credit card debt, there are several options available to consumers. Each option has its unique benefits and considerations, so it’s important to understand the differences between them to choose the best one for your financial situation.

One common consolidation option is a balance transfer credit card. This involves transferring all of your credit card balances onto a new card with a lower interest rate. This can be a great option for those with good credit scores, as they may qualify for introductory 0% APR offers. However, it’s important to be aware of any transfer fees and the regular APR that will apply after the introductory period ends.

Another popular option is a personal loan for debt consolidation. With a personal loan, you can borrow a lump sum of money to pay off all of your credit card debts. This can simplify your payments into one monthly installment with a potentially lower interest rate than your credit cards. Personal loans are available through banks, credit unions, and online lenders, so it’s essential to shop around for the best rates and terms.

For homeowners, a home equity loan or line of credit can be a viable option for consolidating credit card debt. These loans use your home as collateral, so they typically have lower interest rates than unsecured loans. However, there is a risk of losing your home if you fail to make payments, so it’s crucial to weigh the pros and cons before pursuing this option.

Debt management plans offered by credit counseling agencies are another consolidation option. These plans involve working with a credit counselor to negotiate lower interest rates and monthly payments with your creditors. While this can be an effective way to pay off debt, it’s essential to choose a reputable agency and understand any fees associated with the service.

Lastly, debt settlement programs can help you consolidate and negotiate your debt with creditors to settle for less than you owe. This can be a risky option as it can negatively impact your credit score, and there are no guarantees that all of your debts will be settled. It’s essential to research and carefully consider the consequences before enrolling in a debt settlement program.

Overall, the best credit card debt consolidation program will depend on your individual financial situation and goals. It’s essential to carefully evaluate each option, consider the potential risks and benefits, and choose the one that aligns with your needs. By taking the time to understand the different consolidation options available, you can make an informed decision to improve your financial well-being and work towards a debt-free future.

Comparing Interest Rates and Fees

When looking for the best credit card debt consolidation program, it is important to compare the interest rates and fees associated with each option. These factors can greatly impact the overall cost and effectiveness of the program. Here are some key points to consider when comparing interest rates and fees:

1. Interest Rates: One of the most important factors to consider when comparing credit card debt consolidation programs is the interest rate offered. The interest rate will determine how much you will pay in total over the life of the loan. It is important to look for a program that offers a low interest rate to save money in the long run. Make sure to compare the interest rates of different programs and choose the one that offers the most competitive rate.

2. Fees: In addition to interest rates, it is also important to consider any fees associated with the credit card debt consolidation program. Some programs may charge origination fees, balance transfer fees, or other fees that can add to the cost of the program. Be sure to read the fine print and understand all of the fees associated with each program before making a decision. Look for a program that offers low or no fees to save money.

3. Additional Costs: While interest rates and fees are important factors to consider, it is also important to think about any additional costs that may arise during the consolidation process. For example, some programs may require you to pay for credit counseling sessions or financial education courses. These costs can add up over time and impact the overall affordability of the program. Consider all potential costs when comparing programs to ensure you are making the best decision for your financial situation.

4. Fine Print: Lastly, it is crucial to carefully read the fine print of any credit card debt consolidation program before signing up. Make sure you understand all terms and conditions, including any fees, penalties, or restrictions that may apply. Pay close attention to the repayment schedule, as missing payments or paying late can result in additional fees and damage to your credit score. By understanding the fine print, you can ensure that you are making an informed decision and avoiding any surprises down the road.

Overall, when comparing interest rates and fees for credit card debt consolidation programs, it is important to look at the total cost of the program and consider any additional costs that may arise. By doing your research and carefully comparing your options, you can find the best program that meets your needs and helps you achieve your goal of becoming debt-free.

Finding a Reputable Consolidation Program

When searching for the best credit card debt consolidation program, it is crucial to find a reputable company that you can trust. With so many options available, it can be overwhelming to determine which program is the right fit for your financial situation. Here are some key factors to consider when evaluating the credibility of a consolidation program:

1. Research and Reviews: Start by researching different consolidation programs and reading reviews from other clients. Look for feedback on the company’s website, as well as independent review sites. Pay attention to any patterns of complaints or red flags that may indicate a lack of transparency or reliability.

2. Accreditation and Certifications: Check if the consolidation program is accredited by reputable organizations, such as the Better Business Bureau or the National Foundation for Credit Counseling. Accreditation demonstrates that the program meets certain standards of quality and ethics, giving you peace of mind that your finances are in good hands.

3. Transparency and Communication: A trustworthy consolidation program should be upfront about its fees, terms, and conditions. Make sure to ask questions and clarify any doubts before enrolling in the program. Additionally, assess the level of communication and support provided by the company. A reliable program will keep you informed about your progress and be available to address any concerns that may arise.

4. Success Rate and Track Record: One of the most important aspects to consider when choosing a consolidation program is its success rate and track record. Look for testimonials from past clients who have successfully completed the program and improved their financial situation. Additionally, inquire about the program’s average time frame for debt repayment and the percentage of clients who achieve debt relief. A program with a proven track record of helping clients eliminate debt can give you confidence in its effectiveness.

By taking the time to thoroughly evaluate a credit card debt consolidation program based on these factors, you can make an informed decision and choose a reputable program that will help you achieve financial stability and debt relief. Remember that your financial well-being is at stake, so it is crucial to select a program that you can trust to guide you through the process of consolidating and managing your debt.

Steps to Success: Paying Off Debt With a Consolidation Program

When it comes to paying off debt with a consolidation program, there are several steps you can take to ensure success. Here are five key steps to help you on your journey to financial freedom:

1. Assess Your Debt Situation: The first step in paying off debt with a consolidation program is to assess your current financial situation. Take stock of all your debts, including credit card balances, personal loans, and any other outstanding bills. Once you have a clear picture of your debt, you can better understand how much you owe and develop a plan to pay it off.

2. Research Debt Consolidation Options: Next, research the different debt consolidation programs available to you. There are several options to choose from, including balance transfer credit cards, personal loans, and debt management plans. Compare the interest rates, fees, and terms of each program to determine which one is the best fit for your financial situation.

3. Create a Budget: To successfully pay off debt with a consolidation program, you’ll need to create a budget that allows you to make regular payments towards your debt. Take a close look at your income and expenses to determine how much you can afford to dedicate to debt repayment each month. Cut back on unnecessary expenses and redirect that money towards paying off your debt.

4. Stick to Your Repayment Plan: Once you’ve chosen a debt consolidation program and created a budget, it’s important to stick to your repayment plan. Make your payments on time each month and avoid taking on any new debt. It may take time, but with patience and perseverance, you’ll see your debt decrease and your financial situation improve.

5. Stay Motivated: Paying off debt can be a long and challenging process, so it’s important to stay motivated along the way. Celebrate small victories, such as paying off a credit card or reaching a debt milestone. Keep your eye on the prize – financial freedom – and remind yourself of the benefits of being debt-free. Surround yourself with a supportive network of friends and family who can encourage you and hold you accountable on your journey to paying off debt.

By following these five steps, you can successfully pay off debt with a consolidation program and take control of your financial future. Remember, it’s never too late to start on the path to financial freedom – the key is to take that first step and stay committed to your goals.